Bybit, a peer-to-peer (P2P) cryptocurrency derivatives exchange, stands tall in the global digital currency realm. Originating from Singapore and now operating under the helm of Bybit Fintech Limited in the Republic of Seychelles, Bybit’s epicenter is Dubai. This innovative platform is hosted by Amazon Web Services (AWS) Singapore, ensuring top-notch reliability and performance.

The Brains Behind Bybit

The Bybit team is a blend of prowess and innovation, boasting professionals from various sectors: investment banks, tech giants, the foreign exchange industry, and blockchain pioneers. This melting pot of talent includes seasoned experts from Morgan Stanley, Baidu, Alibaba, and Tencent. At the forefront is Ben Zhou, Bybit’s founder and CEO, a veteran of XM, a leading brokerage firm, who brings a wealth of experience in foreign exchange and commodity futures trading.

User Experience and Platform Insights

- User-Friendly Interface: Bybit’s platform is designed to be both intuitive and easy to navigate, making it accessible for all levels of traders.

- Leverage Options: Offering up to 100x leverage on Bitcoin trades and up to 50x on other cryptocurrencies, Bybit empowers traders to maximize their trading strategies.

- Growing User Base: With over two million accounts registered, Bybit’s popularity is a testament to its robust platform.

- Trading Volume: A daily trading volume exceeding $7 billion USD positions Bybit among the highest in the trading world.

- Payment Convenience: Users can effortlessly purchase cryptocurrencies using credit or debit cards.

- Referral Program: An attractive referral system rewards users with $20 for each successful referral.

- Security: A paramount focus on the safety of customer funds enhances trust and reliability.

How to Get Started on Bybit

- Visit Bybit’s homepage and click “Sign Up.”

- Enter your email, choose a password, agree to the Terms and Conditions and Privacy Policies, and sign up.

- Verify your residency status in restricted countries or regions.

- Complete the email and phone verification.

- Start trading on the Bybit trading page.

After providing your email address and choosing a password, as well as acknowledging Bybit’s Terms and Conditions and Privacy Policies, click the “Sign Up” button. Users have the option of signing up with their mobile phone number in addition to their email address. After that, you will be asked to specify whether you are a resident of or a national of one of Bybit’s restricted countries or regions. If this is not the case, click the “No” button.

Is ByBit Safe?

Bybit protects your assets with a variety of different security measures that are in place. Cold storage is used for the storage of all one hundred percent of the client’s funds. In addition to this, it manually examines each withdrawal request on an individual basis in order to prevent any unauthorised withdrawals.

Bybit is a participant in a bug bounty programme, which is a programme that encourages and rewards ethical hackers for finding and reporting vulnerabilities in computer systems.

In addition to that, it conducts background checks on every single employee.

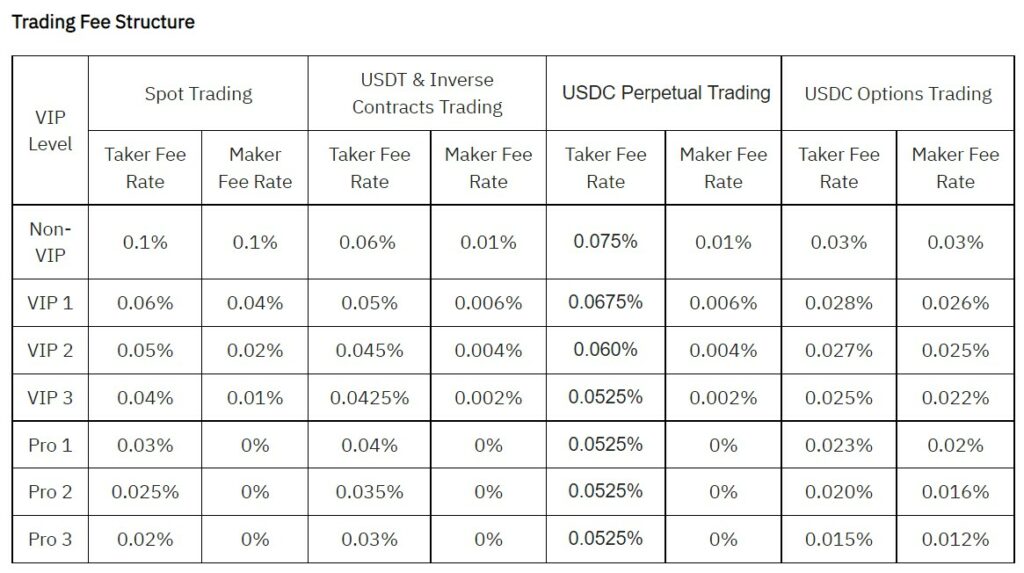

What are ByBit Fees Like?

Trading fees are an essential consideration for us for a variety of self-explanatory reasons. This is especially important to keep in mind when it comes to the payment of fees on a derivatives exchange in situations where your positions are significantly larger than your margin.

Bybit provides a wide range of products, each of which has its own unique pricing structure. The vast majority of them use a model of fees known as “maker-taker.” This indicates that traders are required to pay a fee to the exchange in order to create new liquidity or remove existing liquidity from their order books.

Bybit used to give rebates to any trader who placed a maker order, but since then, rebates have been limited to particular high-volume marker makers and BIT holders. High volume traders on the exchange are referred to as “VIP traders.”

If you are a VIP trader on the exchange, you are eligible to receive exclusive fee discounts through the VIP programme that the exchange provides.

In the image that follows, you’ll find a breakdown of the fees associated with spot and derivative trading products, as well as a breakdown of the fee reductions that are available to different types of VIP and Pro users.

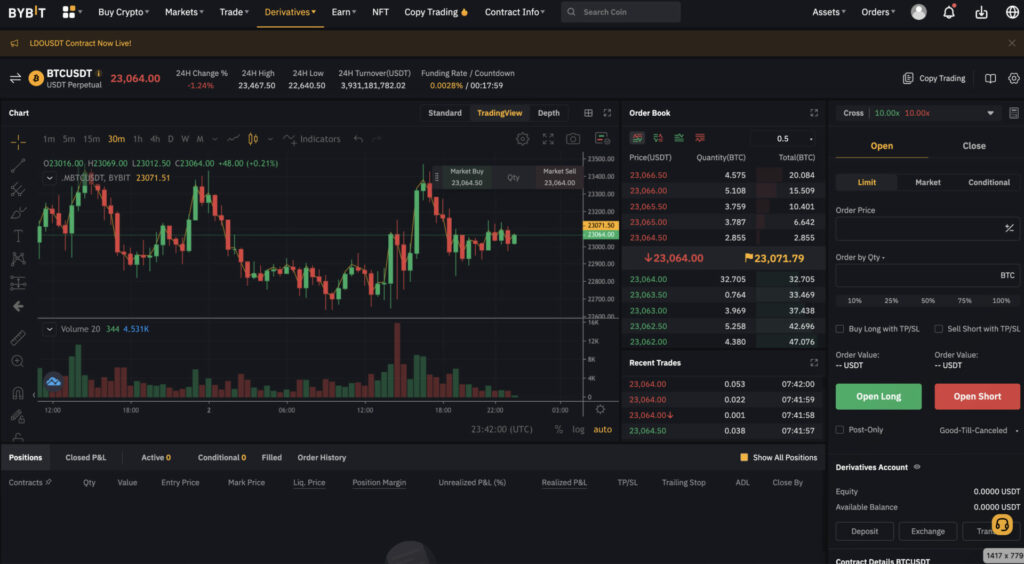

How to Trade Futures on Bybit

Bybit enables users to trade cryptocurrencies through derivative products and spot markets. At the moment, more than 140 crypto trading pairs combinations are supported on the futures and derivatives trading platform including BTCUSDT, EOSUSDT, ETHUSDT, and XRPUSDT.

Bybit provides investors with a variety of synthetic products that can be traded on the derivatives platform so that they can gain exposure to the cryptocurrency market. Traders who use the derivatives platform have the option to either buy/long or sell/short.

Contracts for Inverse Perpetuals are priced in US Dollars or USDT but are traded based on the value of the underlying cryptocurrency. For their margin requirements, traders are required to hold the underlying cryptocurrency. One of the benefits of trading with an inverse perpetual is that investors do not have to purchase stablecoins like USDT in order to meet margin requirements. The fact that traders are required to hedge their margin crypto holdings is a drawback.

BTCUSD, ETHUSD, EOSUSD, and XRPUSD are some of the pair combinations that are supported by inverse perpetuals.

Because it is a perpetual contract, there is no delivery date that is specified, and it can be held indefinitely without the need to roll over contracts in advance of an expiration date.

USDT Perpetuals

Because trades are based on USDT, there is no requirement for traders to hedge their positions in order to reduce the risks associated with holding cryptocurrency as margin. The requirement for traders to acquire stablecoins in order to cover their margin positions is a drawback of USD Perpetuals.

Bybit provides the broadest selection of pairings available through the use of USDT perpetuals. Trade pairs include:

BTCUSDT, ETHUSDT, BNBUSDT, ADAUSDT, DOGEUSDT, XRPUSDT, DOTUSDT, UNIUSDT, BCHUSDT, LTCUSDT, SOLUSDT, LINKUSDT, MATICUSDT, ETCUSDT, FILUSDT, EOSUSDT, AAVEUSDT, XTZUSDT, SUSHIUSDT, and XEMUSDT are some of the currency pairs that are available

In the same way that Inverse Perpetual contracts do not have an expiration date, USDT Perpetual contracts can be held for an indefinite period of time.

Inverse Futures

Inverse futures contracts, on the other hand, are margined and settled in cryptocurrency, in contrast to vanilla futures contracts. Once again, the benefits and drawbacks are comparable to those of inverse perpetual contracts.

BTCUSD and ETHUSD are two of the trade pairs that can be executed through inverse futures contracts. Inverse futures are similar to futures contracts in that they have a predetermined delivery date.

Traders have the option of purchasing cryptocurrency via the “Buy Crypto” page, in addition to the spot platform and the derivatives platform.

If a trader purchases a supported cryptocurrency via the “Buy Crypto” page, the trader’s purchased cryptocurrency will be deposited into the cryptocurrency wallet they specify.

After their accounts have been funded, traders are then able to trade across the entire Bybit product suite.

Charts Traders on the Bybit platform have access to charts that are powered by TradingView.

Users have access to multiple time intervals and a comprehensive variety of technical indicators, making this platform suitable for experienced traders interested in conducting technical analysis.

It is essential that traders have the ability to draw charts in order to manage their crypto risk exposures on a continuous basis.

Bybit Trading Bots

Bybit also provides its customers with a service known as “grid trading bots.” In their most basic form, grid bots are essentially automated trading strategies that users can programme. They are programmed to place orders to buy and sell at set intervals within a price range that has been determined in advance.

Grid bots seek to profit from price fluctuations, so they operate most effectively in markets that are highly volatile. In the spot market, grid trading is accessible through desktop platforms as well as app versions of the trading platform.

Users have the ability to devise their very own grid trading bot strategies by determining the upper and lower price bands, as well as the total number of grids and investment amount. To illustrate this point, let’s assume that trader A implements their grid strategy by setting an upper price band of $24,000 and a lower price band of $21,000 USD. After that, they go on to specify the number of grids that are located between the range and the interval that corresponds to it. Trader A creates a total of three grids, each with a $1000 gap between them. Following the completion of the configuration of the parameters governing their strategy, the trading bot goes into action and begins placing orders to either buy or sell at intervals of $500 within the range.

For instance, if the price of the asset reaches $24,000, the sell order will be carried out, and an order to purchase the asset at $23,000 will be placed above the grid in the next position. At the point in time when the price reaches $23,000, the buy order will be carried out, and a sell order will be positioned at $24,000. This results in a strategy that is similar to a grid.

The grid trading strategy will be put on hold in the event that the price moves outside of the specified price bands. At this point, the user has the option of either continuing to use the grid trading strategy, which will allow them to make the most of their available capital, or waiting for the price to return to the range that they have set, at which point the strategy will resume.

When a user makes a profit through grid trading, that profit will automatically be credited to their ‘BOT Account.’ When the grid trading strategy has been finished, the user’s funds will be automatically moved from their BOT Account to their Bybit Spot Account. This will take place once the grid trading strategy has been finished.

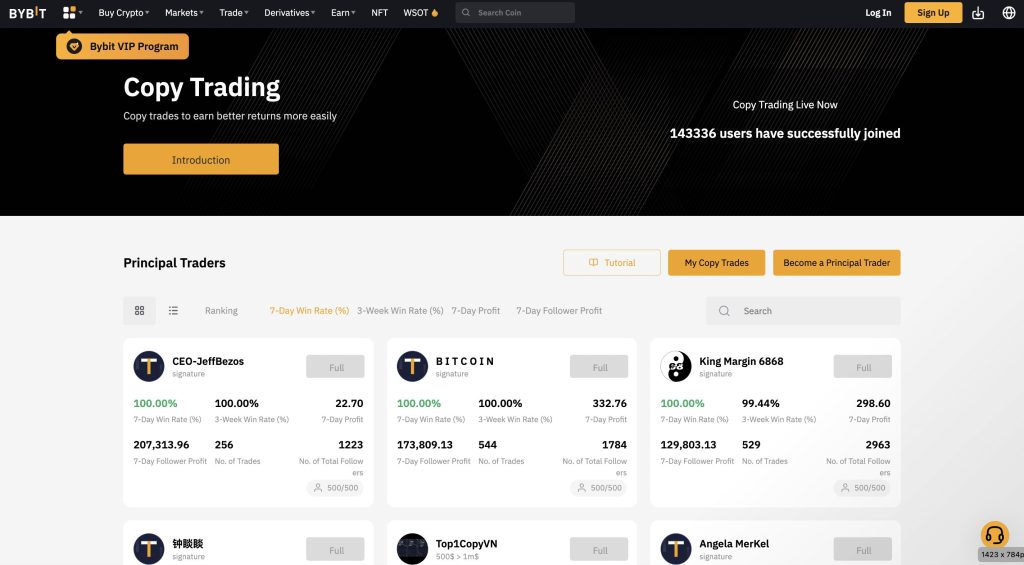

How to Copy Trade on Bybit

People who do not have adequate experience in cryptocurrency trading but want to gain exposure to the market are increasingly turning to the concept of copy-trading as a way to do so.

You are essentially granted the ability to automatically replicate the trades carried out by other users of the platform. You can determine which traders you want to copy by monitoring their trading performance and overall profitability over a predetermined amount of time and then selecting those traders to copy. Here is an example of what the dashboard for copy trading looks like:

You are able to look at all of the users who are permitted to be copied from this location, and then choose those users with whom you have the most in common based on a variety of factors including risk profile, number of followers, assets under management, win rate, return on investment, and many more.

You need to find someone who does not have a label at the top that says “Full,” which indicates that there is no more room for followers to tune in. As soon as you have done so, simply click on their profile, and then hit the Follow button that is located on the top right of the page. After that, you will be able to adjust the specifics of the mode in accordance with your own individual preferences:

Bybit’s Earn Program

By offering its users a variety of products under the “Earn” programme, Bybit makes it possible for them to generate residual income from unused assets in their possession. Be aware, however, that in order to participate in the “Bybit earn” programme, users of the exchange must first complete the requirements of level 1 of the Know Your Customer process.

The following categories of goods can be purchased through the company’s “Earn” programme:

Bybit Savings is a feature of the Bybit platform that enables users to store their assets on the network for a predetermined amount of time in exchange for interest on those assets. There are two distinct kinds of savings programmes that can be chosen from: flexible and fixed term. The interest rate on locked-up assets in flexible term savings accounts is lower, but the account holder is free to withdraw their money whenever they like. Fixed term savings, on the other hand, offer interest rates that are relatively higher but require the user to lock the assets away for a fixed number of days, most commonly 30 or 60 days.

Bybit Liquidity Mining – The Bybit liquidity mining programme enables users to contribute liquidity to AMM pools. The liquidity provider can then earn swap fees from other users in the pool when they trade assets with one another. In comparison to the savings programme, liquidity mining typically provides a higher rate of return for its participants. Users also have the option to add leverage, which allows them to increase their share of the pool and maximise the yield they receive. Adding leverage, on the other hand, puts the user in danger of having their account liquidated.

Bybit Dual Asset – Users of the Dual Asset programme have the opportunity to profit from higher returns in markets that experience low levels of volatility. Users are required to forecast the movement of a particular cryptocurrency asset, such as BTC or ETH, within a predetermined timeframe and deposit their preferred cryptocurrency in order to lock in the higher yield. This can be accomplished by using a cryptocurrency forecasting tool. At the time of maturity, the user will receive one of the two assets that make up the asset pair. Which asset they receive depends on how the settlement price compares to the benchmark price.

Bybit Launchpool – The Bybit launchpool gives users the opportunity to stake the native BIT token of the exchange in order to earn free tokens from partnered projects. This opportunity is only available during the event. At any time, the staking of these tokens can be revoked.

Bybit Defi Mining is a programme developed by Bybit that enables users to earn yield from different Defi platforms, such as Curve, by staking assets using Bybit. Users are now able to participate in Defi without having to worry about the management of their wallets. The Defi mining programmes offered by Bybit typically last for a period of seven days.

Conclusion

Bybit is a reliable exchange that features a plethora of functions that are either rare or difficult to locate elsewhere. early access to tokens, an integrated marketplace for NFTs, and trading contracts. You’ll have the ability to trade using leverage, and its intuitive user interface will make it easy for you to manage your positions.

However, there is a significant amount of room for improvement. And it might begin with instituting a stringent Know Your Customer policy in order to welcome Bybit USA traders. More importantly, the implementation of a stringent ID verification process can increase its legitimacy in the eyes of regulatory authorities.

To summarize, Bybit is the right exchange for you if :

- You do not live in the United States, but you are interested in trading with margin.

- You are comfortable using more sophisticated financial instruments.

- You are not afraid of taking risks and have expressed an interest in becoming proficient in the use of cryptocurrency derivatives.

- You would like to be able to mirror experienced trader trades by using the Bybit copytrading feature