Bitget, renowned as the world’s leading crypto copy trading platform, offers an intuitive yet comprehensive approach to copy trading. This article delves into the critical aspects of the process, aimed at equipping both seasoned and novice traders with essential insights for successful trading.

We’ll cover everything from understanding elite trader data to setting up, managing, and closing your copy trades.

Copy Trading on Bitget is a feature that allows you to automatically replicate the trading actions of experienced and successful traders within the Bitget platform. This method is particularly appealing for those new to trading or those who wish to benefit from the insights of more seasoned traders. Essentially, when the trader you are copying makes a move, such as buying or selling a cryptocurrency, the same trade is executed in your account based on the proportion you’ve set.

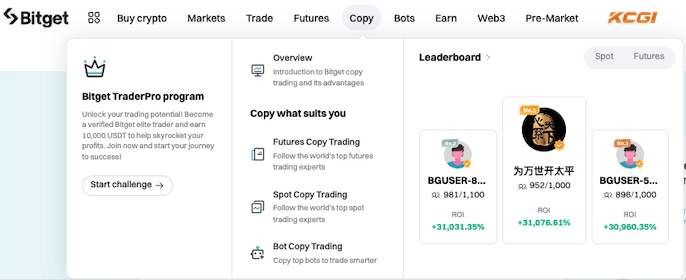

Types of Copy Trading

1. Spot Copy Trading

This is a form of trading where you, as an investor, can automatically copy the trades of more experienced or successful traders. Imagine it like following a recipe from a chef you admire.

When they make a trade (buy or sell), your account does the same. You’re essentially mirroring their trading actions, hoping their expertise leads to successful investments for you too.

2. Futures Copy Trading

This is similar to regular spot copy trading but specifically with futures contracts. Futures contracts are agreements to buy or sell an asset at a predetermined future date and price.

So, when you’re doing futures copy trading, you’re copying how expert traders buy and sell these future contracts. It’s like riding in the same boat as a skilled sailor, navigating the future markets.

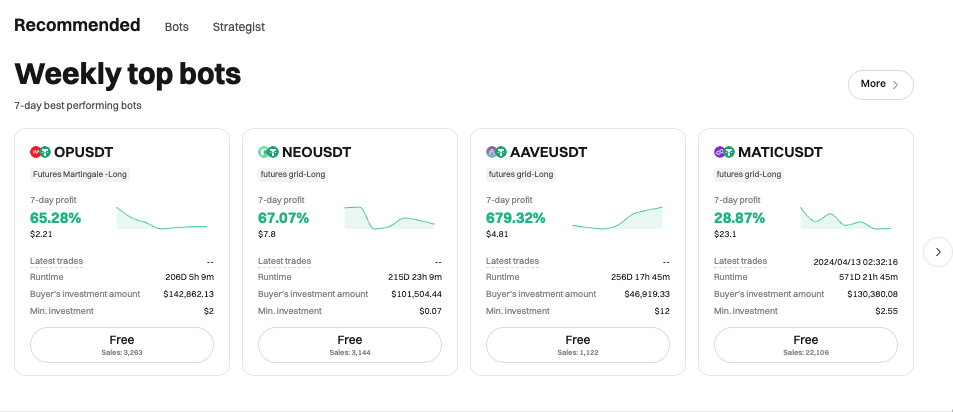

3. Bot Copy Trading

Instead of following a human trader, you’re copying trades executed by a programmed algorithm or bot. These bots are designed to follow specific trading strategies and make decisions based on market data, trends, and other factors. It’s like setting your car on autopilot, where the driving decisions are made based on pre-programmed routes and conditions.

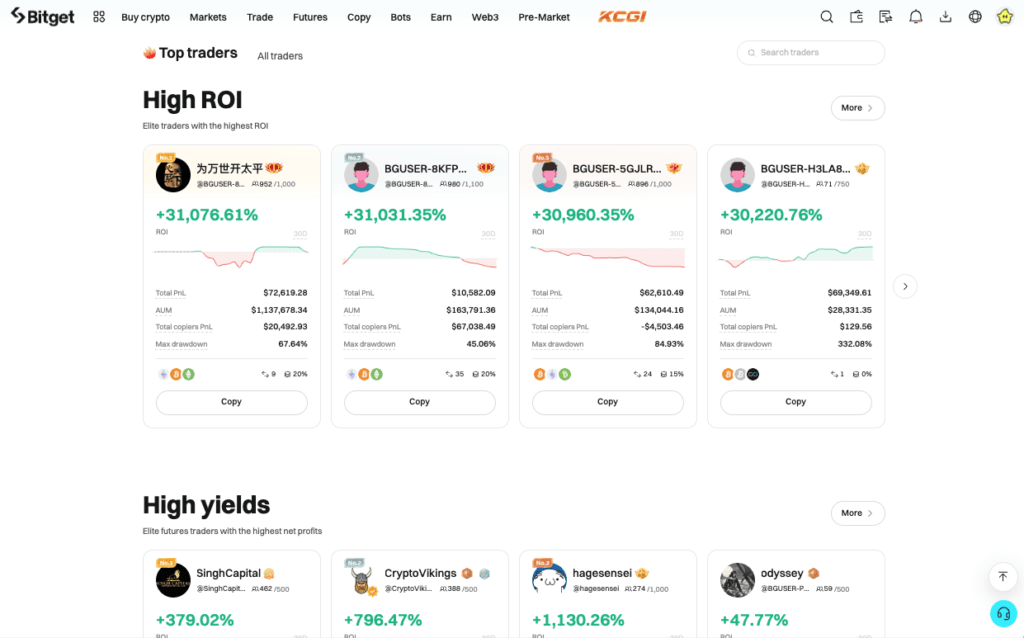

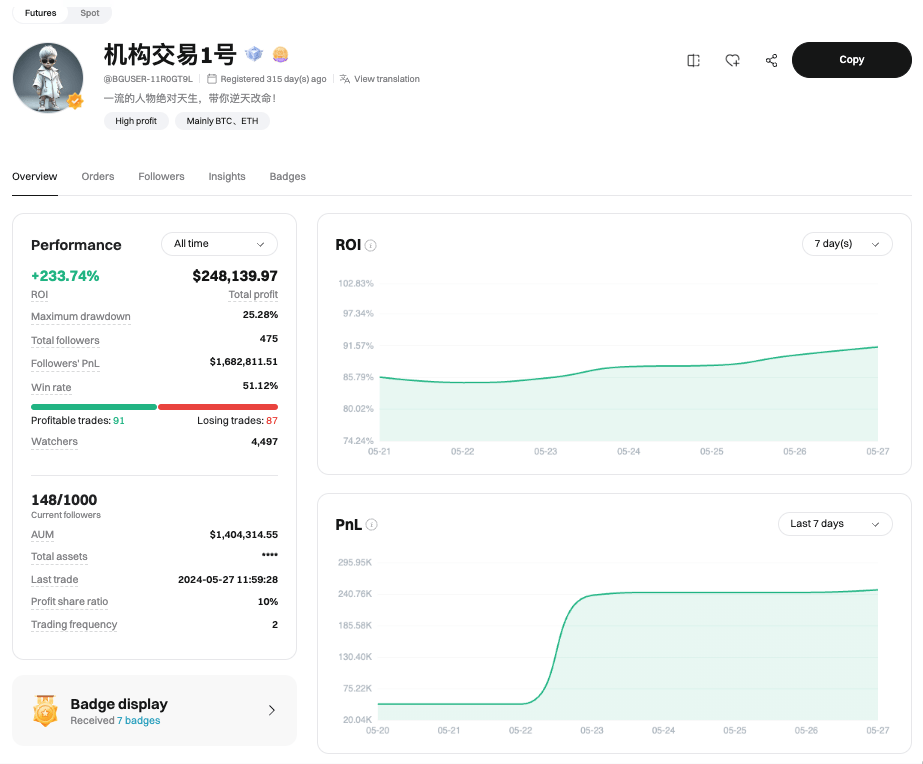

Understanding Elite Trader Data

When selecting traders to copy, consider various metrics:

- Registration days: Time since the trader joined Bitget.

- Followers: Current count of the trader’s followers.

- Total Assets: Assets in the trader’s account.

- Return on Investment (ROI): Calculated as PnL divided by Principal, multiplied by 100%.

- Total Transactions: Count of completed transactions (opening and closing positions).

- Followers (All-Time): Total number of followers over time.

- Total P&L: Total profit and loss from closed orders.

- Profitable Trades: Number of trades yielding positive returns.

- Losing Trades: Number of trades resulting in negative returns.

- Win Rate (3W): Proportion of profitable orders in the last 3 weeks.

Data updated hourly.

The Copy Trading Process

Embarking on copy trading involves several key steps:

1. Choosing Traders

- Access trader data on the copy trading page.

- Follow multiple elite traders simultaneously.

- Opt for slot reminders if a trader is at full capacity.

2. Setting Up Your Account

- Select the trader to copy.

- Choose the copy method: fixed amount, multiplier, or fixed quantity.

- Opt for common or advanced settings for detailed configurations.

- Implement risk control measures like take-profit and stop-loss ratios.

3. Monitoring Copy Trade Data

- Review invested principal, net profit, and current and historical copy trades.

- Track the elite traders you’re following.

4. Editing Copy Trades

- Modify settings or unfollow traders through the ‘My Traders’ section.

- Changes apply only to new orders; existing ones remain unaffected.

5. Closing Positions

- Close copied positions via ‘My Copy Trades’ or the page.

- Positions of the same direction will be merged.

Do You Need Copy Trading?

Whether you need copy trading depends on your individual trading goals, experience, and the amount of time you can dedicate to trading:

1. For Beginners

If you’re new to the world of cryptocurrency trading, copy trading can be an excellent way to learn. By mirroring the trades of experienced traders, you gain insights into strategy and decision-making without needing deep market knowledge from the start.

2. Time Constraints

If you’re interested in trading but don’t have the time to analyze markets and execute trades, copy trading can automate this process for you.

3. Diversifying Strategies

Even if you’re an experienced trader, copy trading can be a way to diversify your strategies by incorporating the perspectives and techniques of other successful traders.

4. Risk Consideration

It’s important to remember that all forms of trading carry risk. Even the most experienced traders can make losing trades. Therefore, it’s crucial to do your research and set appropriate risk management measures.

Joining Bitget for Copy Trading

By joining Bitget, traders can navigate the vibrant world of cryptocurrency with the added advantage of learning from and copying the strategies of elite traders. The platform’s user-friendly interface, combined with a robust support system, makes it an ideal choice for anyone looking to dive into copy trading.

This guide offers just a glimpse into the dynamic world of Bitget’s copy trading. For a more in-depth understanding, read our latest Bitget review, follow Bitget’s latest updates and join their thriving community.