Copy trading is an increasingly popular solution in the cryptocurrency market, especially favored by relatively novice investors.

This strategy allows traders to copy the investments of more experienced traders, thereby automating their investments and benefiting from the wisdom of seasoned traders. Several platforms offer copy trading, each with its unique features and advantages. In this article, we will discuss three prominent copy trading platforms: Bitget, Bybit, and MEXC. By examining these platforms individually, you will be able to observe the differences and choose the one that best suits your needs.

What is Copy Trading?

Copy trading is a trading strategy that enables traders, often amateurs, to replicate the trades of more experienced traders. This method is particularly popular because it allows for automated investments while benefiting from the expertise of experienced traders.

Advantages of Copy Trading

- Time Efficiency: Copy trading saves considerable time, making it ideal for investors who lack the time to monitor the market.

- Access to Expertise: This strategy provides access to high-level expertise, offering both security and educational opportunities by observing the decision-making processes of the traders you copy.

- Learning Opportunity: By following experienced traders, investors can learn and improve their trading skills.

Disadvantages of Copy Trading

- Dependency on Third Parties: Your gains and losses depend on another person’s decisions, which can lead to a sense of helplessness in case of poor decisions.

- Fees and Commissions: Many platforms charge fees and commissions for copy trading services, making it essential to choose a platform wisely.

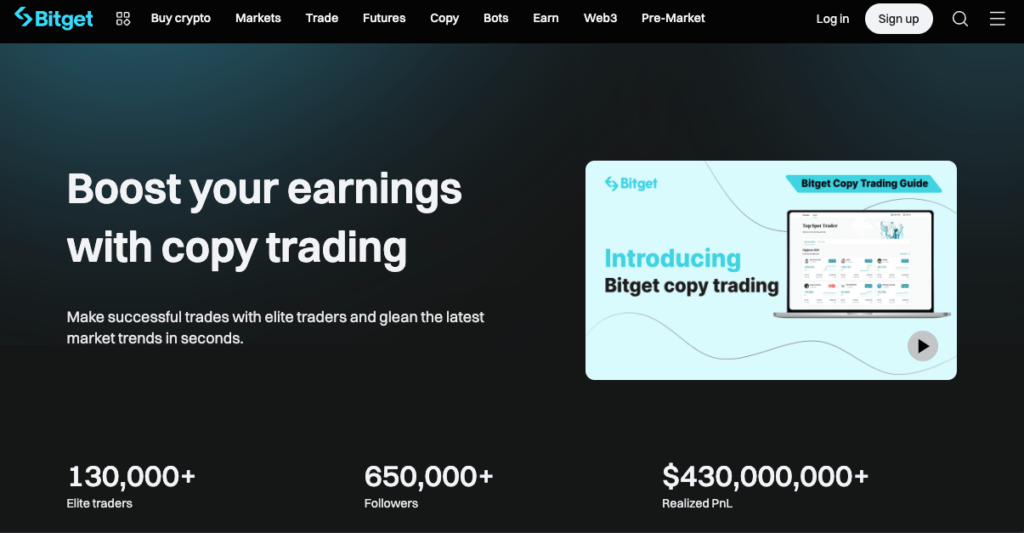

Bitget

Bitget is a leading platform in the copy trading market, recognized for pioneering several flagship products. The platform boasts over 630,000 subscribers using strategies provided by experienced traders.

How to Access Copy Trading on Bitget

To access copy trading on Bitget, visit the platform’s homepage and click on the “Copy” tab in the upper bar of your screen.

One-Click Copy Trade

Bitget’s flagship product, One-Click Copy Trade, introduced in 2020, has been a major innovation and its growing popularity testifies to its success. This service allows users to gain precise insights into the quality of the traders’ decisions, thanks to its transparency.

Transparency and Trader Evaluation

Every trader available on Bitget’s copy trading service undergoes a rigorous examination. Users can access the traders’ trading history, including losses, profits, and all orders placed, to help make informed choices. Additionally, users can follow multiple traders simultaneously to maximize their profits.

Additional Services on Bitget

Spot Market Copy Trading

Bitget also offers copy trading in the spot market, enabling users to replicate the strategies of experienced traders without engaging in complex futures contracts.

Trading Bots: Copy and Create

Bitget distinguishes itself with its trading bot options, allowing users to either copy existing bots or create their own. This flexibility caters to traders of all levels, from beginners to experts.

- Spot Auto-Invest Bot: Ideal for passive investment strategies, this bot automatically manages operations based on predefined parameters.

- Spot Grid Bot: Designed to capitalize on market fluctuations, placing buy and sell orders at different price levels.

- Futures Trading Grid Bot: Similar to the Spot Grid bot but tailored for the futures market.

Social Copy Trading

Bitget emphasizes the social aspect of copy trading with its platform “Insights”, resembling a social network where traders share ideas and results. Traders are incentivized to offer their trades to the community by earning rewards when someone profits from copying their strategy.

Statistics and Fees

Bitget supports copy trading on over 250 cryptocurrencies and allows for leverage. Notably, users must share 8% of their gains with the trader they copy.

Bybit

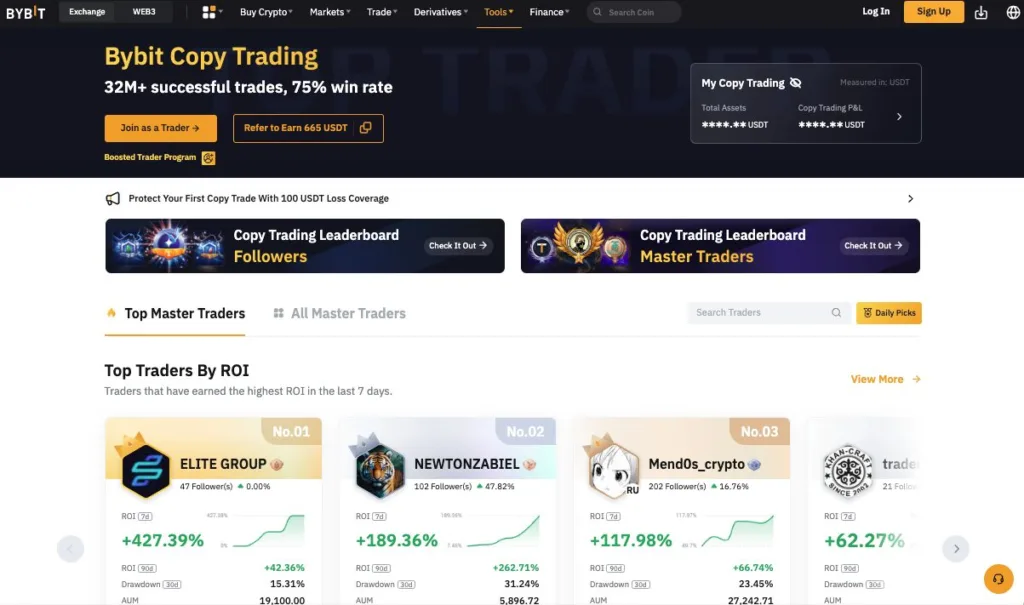

Bybit is another prominent platform in the copy trading market, offering competitive trading fees and a unique profit-sharing mechanism.

Accessing Copy Trading on Bybit

To access copy trading on Bybit, go to the “Tools” tab in the upper bar and select “Copy Trading” from the dropdown menu.

Copy Trading Modes on Bybit

- Spot Copy Trading

- Futures Copy Trading

The main difference between these modes lies in the risk and potential returns. Futures copy trading involves riskier products but offers higher returns, while spot copy trading provides more security and stability with lower yields.

Profit-Sharing Mechanism

Bybit requires users to share 10% to 15% of their profits with the lead traders. Additionally, users can only copy seven trades in “Open/Closed” mode and one trader in “Buy/Sell” mode.

Protection Against Slippage

Bybit offers 0.5% slippage protection when opening positions, safeguarding copy traders from potential delays between the trader’s decision and their account’s reaction.

Statistics and Leverage

Bybit supports copy trading on over 270 cryptocurrencies and permits leverage, albeit with specific restrictions detailed in their leverage table.

MEXC

MEXC is a historical platform in the cryptocurrency market, offering copy trading to its users.

Trader and Follower Roles

MEXC allows users to become either Traders (providing strategies) or Followers (copying strategies). Traders must be experienced to be accepted, while followers have no specific restrictions.

Profit Sharing

Followers must share a portion of their profits with the trader based on a predetermined ratio set by the trader.

Transparency and Leaderboard

MEXC offers a leaderboard accessible via the “Copy Trading” tab, where users can sort traders by characteristics like P&L (%) or total P&L. Detailed profiles, including trading history and frequency, are available for each trader.

Conclusion

Each platform has its unique policies and features regarding copy trading. Bitget aims to establish itself as a long-term leader with comprehensive services and social trading aspects.

Bybit offers a competitive edge with unique profit-sharing and protection mechanisms, while MEXC provides a transparent and historical option for copy trading.

The diversification of copy trading platforms is a positive development for novice and occasional traders, allowing easy access to the expertise of experienced traders. However, all platforms require sharing a portion of profits with the trader being copied, emphasizing the importance of careful selection and strategic planning.